ARGUS GLOBAL MARKETS

North Sea benchmark robustness questioned

Spot trade of the four grades that comprise the North Sea benchmark have eased this year, raising concerns about the robustness of the global marker.

The North Sea benchmark is set daily by the lowest priced of Brent, Forties, Oseberg or Ekofisk (BFOE). But spot trade of these four benchmark-setting crudes fell to 285,000 b/d in the first seven months of this year, down from 310,000 b/d in the same period a year earlier. Spot trade of the BFOE grades had previously been on the rise, climbing to 320,000 b/d in 2015, up from 260,000 b/d a year earlier and 245,000 b/d in 2013.

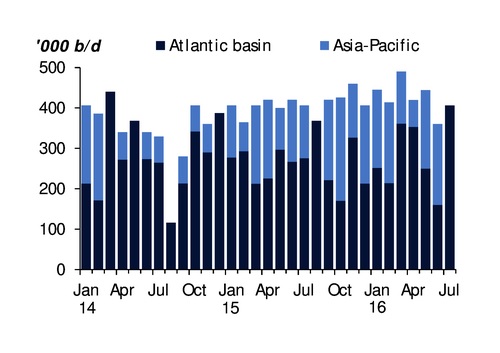

The easing of spot trade comes as a growing portion of the benchmark-setting crude production is shipped out of northwest Europe. The flow of crude east and west threatens to reduce transparency, as cargoes leave the North Sea without trading publicly, and could limit the amount of physical trade that underpins the North Sea marker. Asia-Pacific buyers took around 140,000 b/d of Forties crude in the first seven months of this year, little changed from exports in the same period a year earlier (see graph). But the eastbound flow has not been limited to Forties. Nearly 20,000 b/d of Ekofisk sailed for Asia-Pacific in January-July compared with less than 5,000 b/d for the whole of 2015.

The rise in eastward North Sea crude exports has been driven by Chinese demand growth, as China's so-called teakettle refiners have increased crude purchases. But the teakettles may have overbought, which could weigh on the country's appetite for crude in the second half of this year.

Increasing quantities of North Sea crude have also been moving transatlantic, as North Sea Dated's premium to US marker grade WTI has narrowed. At least 20,000 b/d of Ekofisk has sailed to the Americas from the UK's Teesport terminal this year — with cargoes exported to Canada, Uruguay and Portland in the US — compared with under 10,000 b/d in the same period a year earlier. Other grades have also made the voyage. Nearly 40,000 b/d of Norwegian crude was shipped west in July from Sture — where the Oseberg and Grane grades are loaded — to Martinique and Canada. And 30,000 b/d was exported to the US Gulf coast from the North Sea last month — including from Shell's Pierce field and from Sullom Voe, where Brent and Clair are loaded.

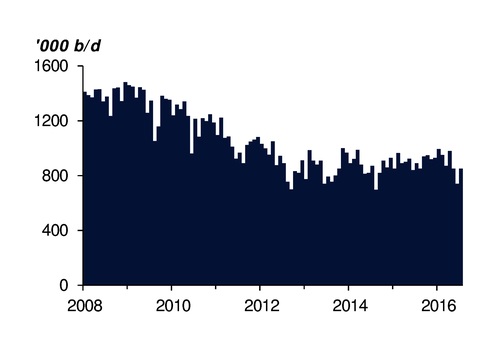

A decline in production could also undermine the North Sea benchmark. Output has defied expectations so far in 2016, but production is expected to fall in the second half of this year — curbed by several maintenance shutdowns (see graph). And a return to a long-term output decline is forecast, as the sharp drop in oil prices that began in the second half of 2014, and the ensuing lack of upstream investment, takes its toll on the North Sea region's ageing fields.

Loadings of the four BFOE grades averaged 885,000 b/d in the first seven months of this year, down from 895,000 b/d in January-July 2015. And a further decline is expected in August-December, as the month-long September shutdown of the UK's largest field — the 180,000 b/d Nexen-operated Buzzard — hits Forties output, while the closure of the Karsto gas processing facility on 27 August-17 September will potentially shut-in up to 260,000 b/d of Norwegian crude.

Forecast UK production of 950,000 b/d in the second half of this year is 12pc lower than in January-June, while Norwegian output will fall to 1.91mn b/d in July-December from 1.97mn b/d in the first six months of 2016, according to the IEA. The Norwegian Petroleum Directorate expects Norwegian liquids production of 1.88mn b/d in the second half of this year, compared with output of 1.99mn b/d in January-June.

This story was published in Argus Global Markets. f you would like to see more high-quality analytical commentary on key oil industry developments and pricing and trading behaviour, request a free trial.

The easing of spot trade comes as a growing portion of the benchmark-setting crude production is shipped out of northwest Europe. The flow of crude east and west threatens to reduce transparency, as cargoes leave the North Sea without trading publicly, and could limit the amount of physical trade that underpins the North Sea marker. Asia-Pacific buyers took around 140,000 b/d of Forties crude in the first seven months of this year, little changed from exports in the same period a year earlier (see graph). But the eastbound flow has not been limited to Forties. Nearly 20,000 b/d of Ekofisk sailed for Asia-Pacific in January-July compared with less than 5,000 b/d for the whole of 2015.

The rise in eastward North Sea crude exports has been driven by Chinese demand growth, as China's so-called teakettle refiners have increased crude purchases. But the teakettles may have overbought, which could weigh on the country's appetite for crude in the second half of this year.

Increasing quantities of North Sea crude have also been moving transatlantic, as North Sea Dated's premium to US marker grade WTI has narrowed. At least 20,000 b/d of Ekofisk has sailed to the Americas from the UK's Teesport terminal this year — with cargoes exported to Canada, Uruguay and Portland in the US — compared with under 10,000 b/d in the same period a year earlier. Other grades have also made the voyage. Nearly 40,000 b/d of Norwegian crude was shipped west in July from Sture — where the Oseberg and Grane grades are loaded — to Martinique and Canada. And 30,000 b/d was exported to the US Gulf coast from the North Sea last month — including from Shell's Pierce field and from Sullom Voe, where Brent and Clair are loaded.

A decline in production could also undermine the North Sea benchmark. Output has defied expectations so far in 2016, but production is expected to fall in the second half of this year — curbed by several maintenance shutdowns (see graph). And a return to a long-term output decline is forecast, as the sharp drop in oil prices that began in the second half of 2014, and the ensuing lack of upstream investment, takes its toll on the North Sea region's ageing fields.

Loadings of the four BFOE grades averaged 885,000 b/d in the first seven months of this year, down from 895,000 b/d in January-July 2015. And a further decline is expected in August-December, as the month-long September shutdown of the UK's largest field — the 180,000 b/d Nexen-operated Buzzard — hits Forties output, while the closure of the Karsto gas processing facility on 27 August-17 September will potentially shut-in up to 260,000 b/d of Norwegian crude.

Forecast UK production of 950,000 b/d in the second half of this year is 12pc lower than in January-June, while Norwegian output will fall to 1.91mn b/d in July-December from 1.97mn b/d in the first six months of 2016, according to the IEA. The Norwegian Petroleum Directorate expects Norwegian liquids production of 1.88mn b/d in the second half of this year, compared with output of 1.99mn b/d in January-June.

This story was published in Argus Global Markets. f you would like to see more high-quality analytical commentary on key oil industry developments and pricing and trading behaviour, request a free trial.

Forties destinations

BFOE production

Thanks!

You are now able to view the article in full.

Want more crude oil news?

You are now able to view the article in full.

Want more crude oil news?

For more information about our comprehensive coverage of global crude markets and our range of price assessments, check out Argus Global Markets.