ARGUS EUROPEAN NATURAL GAS

US LNG relies on global demand growth and Dutch Gate

Copyright © 2018

All rights reserved

Notice: By accessing this site you agree that you will not copy or reproduce any part of its contents (including, but not limited to, single prices, graphs or news content) in any form or for any purpose whatsoever without the prior written consent of the publisher.

ARGUS, the ARGUS logo, ARGUS MEDIA, ARGUS DIRECT, ARGUS OPEN MARKETS, AOM, FMB, DEWITT, JIM JORDAN & ASSOCIATES, JJ&A, FUNDALYTICS, METAL-PAGES, METALPRICES.COM, Argus publication titles and Argus index names are trademarks of Argus Media Limited.

Download now:

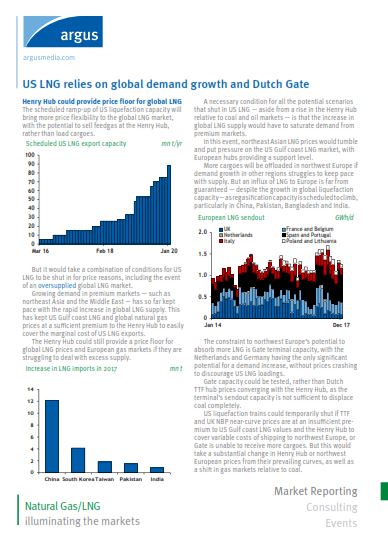

The scheduled ramp-up of US liquefaction capacity will bring more price flexibility to the global LNG market, with the potential to sell feedgas at the Henry Hub, rather than load cargoes.

But it would take a combination of conditions for US LNG to be shut in for price reasons, including the event of an oversupplied global LNG market.

This white paper, featuring coverage from Argus European Natural Gas, takes a forward look at possible scenarios against various market fundamentals.

But it would take a combination of conditions for US LNG to be shut in for price reasons, including the event of an oversupplied global LNG market.

This white paper, featuring coverage from Argus European Natural Gas, takes a forward look at possible scenarios against various market fundamentals.

HIGHLIGHTED CONTENTS:

- Henry Hub could provide price floor for global LNG

- China drives global demand higher

- Dutch and German power sectors provide resistance

- Oil price rise reduces possibility of US LNG shut-in