Get a view of the markets around the world. Our regional editors have summarised the key trends for LPG markets this month.

Scroll down or navigate to each regional commentary using the buttons below

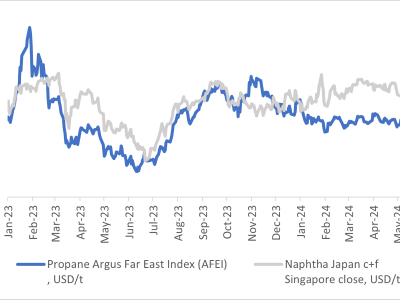

Asian propane prices held steady in August, mirroring stable crude benchmarks. The average August Argus Far East Index (AFEI) eked out a 0.5pc gain on the month as strong demand absorbed record-breaking exports from the US.

US exports grew to 6.14mn t in August, with 3.4mn t headed to the Asia-Pacific region.

Demand growth from China’s petrochemical sector supported prices.

The front-month Asian propane-naphtha spread averaged a $27/t discount in August, compared with $52/t in July, as robust Asian demand boosted LPG values.

Taiwan’s Formosa Plastics cancelled tenders three times for September shipments as a result of unattractive switching economics.

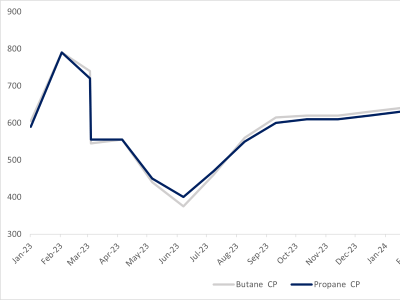

Saudi Arabia’s state-controlled Saudi Aramco raised the September propane contract price (CP) to $605/t, up from the previous month, while the September butane CP was increased by $25/t.

Strong demand from India for evenly split ratio cargoes contributed to the higher hike in CP postings.

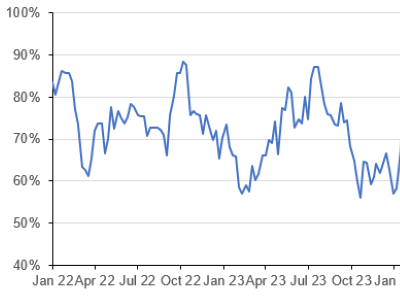

Operating rates at Chinese propane dehydrogenation (PDH) plants fell to a four-month low of 63pc at the end of August, compared with July’s monthly average of 73pc, in the wake of rising propane feedstock prices.

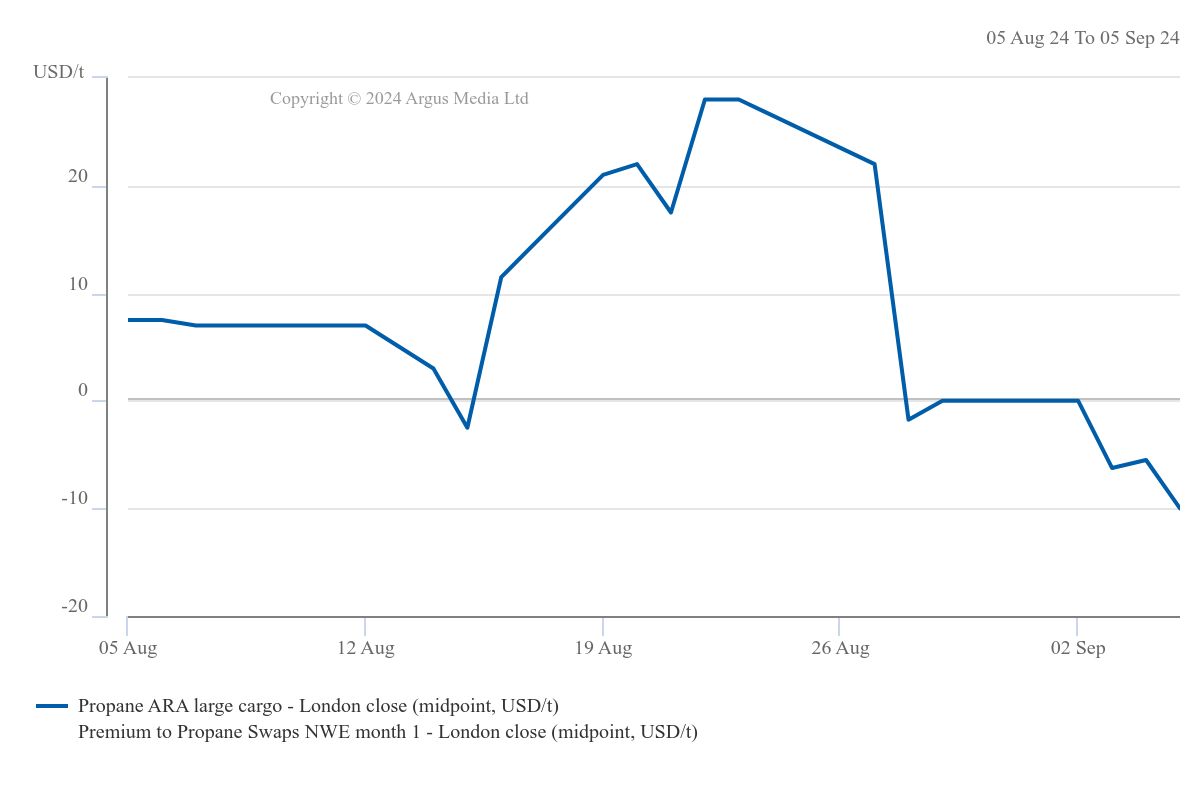

The large cargo propane cif Amsterdam-Rotterdam-Antwerp (ARA) price premium to the underlying front-month swap hit an 18-month high of $28/t in August — indicating a sign of tightness in the spot market — but retreated in early September, flipping into a $10/t discount after an aggressive bid for a mid-September cargo was replaced by a bearish offer. Tight prompt supply drove the initial sudden gains as one of the main suppliers to the region, Norway's 97.6mn m³/d Karsto gas processing plant, began a near-month-long maintenance at the end of August. Curtailed North Sea supply made importers more reliant on US deliveries, pitching them against bullish Asia-Pacific buyers.

Spot prices for October-loading propane cargoes fell to Mont Belvieu +21.5¢/USG by the end of August, down from a multi-year high of +27.5¢/USG earlier in the month, as Enterprise Products resumed offering cargoes on a spot basis for mid-September, following months of weather-related delays that have plagued loading schedules at several US Gulf coast terminals all summer.

Despite the loading setbacks, US propane exports have been brisk, averaging 1.7mn b/d in August, up from 1.6mn b/d in July, according to the US Energy Information Administration (EIA).

Steady demand for propane has bolstered US prices relative to Nymex WTI, leaving Mont Belvieu, Texas, propane valued at 43pc of Nymex crude at the end of August.

US butane prices at Mont Belvieu rose to 58pc of Nymex WTI at the end of August from 44pc last year, as an early start to the domestic blending season for winter-grade gasoline bolstered buying interest.

Spot ethane prices at Mont Belvieu remained depressed owing to declines in natural gas pricing in west Texas and maintenance activity. Mont Belvieu ethane ended August at 11.25¢/USG, down versus the 28.1875¢/USG seen at the end of August 2023. Weakness in ethane came as natural gas prices at Waha, Texas, extended further into negative territory in late August, widening ethane’s premium relative to its fuel value in the natural gas stream, suggesting that gas processing plants in west Texas will maintain maximum rates of ethane extraction in the month ahead.

This information comes from our suite of regular LPG market services. For daily prices and market commentary: Argus LPG International and Argus NGL Americas. For regular, detailed market insights: Argus LPG World. For forecasts on prices and market fundamentals: Argus LPG Outlook and Argus Analytics – LPG Service.