Lorem ipsum dolor amet consetur adiisicing elit, sed eiusmod tepor incididunt dolore magna aliqua quis nostrud voluptate.

Find out more

Lorem ipsum dolor amet consetur adiisicing elit, sed eiusmod tepor incididunt dolore magna aliqua quis nostrud voluptate.

Find out more

Lorem ipsum dolor amet consetur adiisicing elit, sed eiusmod tepor incididunt dolore magna aliqua quis nostrud voluptate.

Find out more

Lorem ipsum dolor amet consetur adiisicing elit, sed eiusmod tepor incididunt dolore magna aliqua quis nostrud voluptate.

Find out moreThis information comes from our suite of regular LPG market services. For daily prices and market commentary: Argus LPG International and Argus NGL Americas. For regular, detailed market insights: Argus LPG World. For forecasts on prices and market fundamentals: Argus LPG Outlook and Argus Analytics – LPG Service.

Click here to enlarge

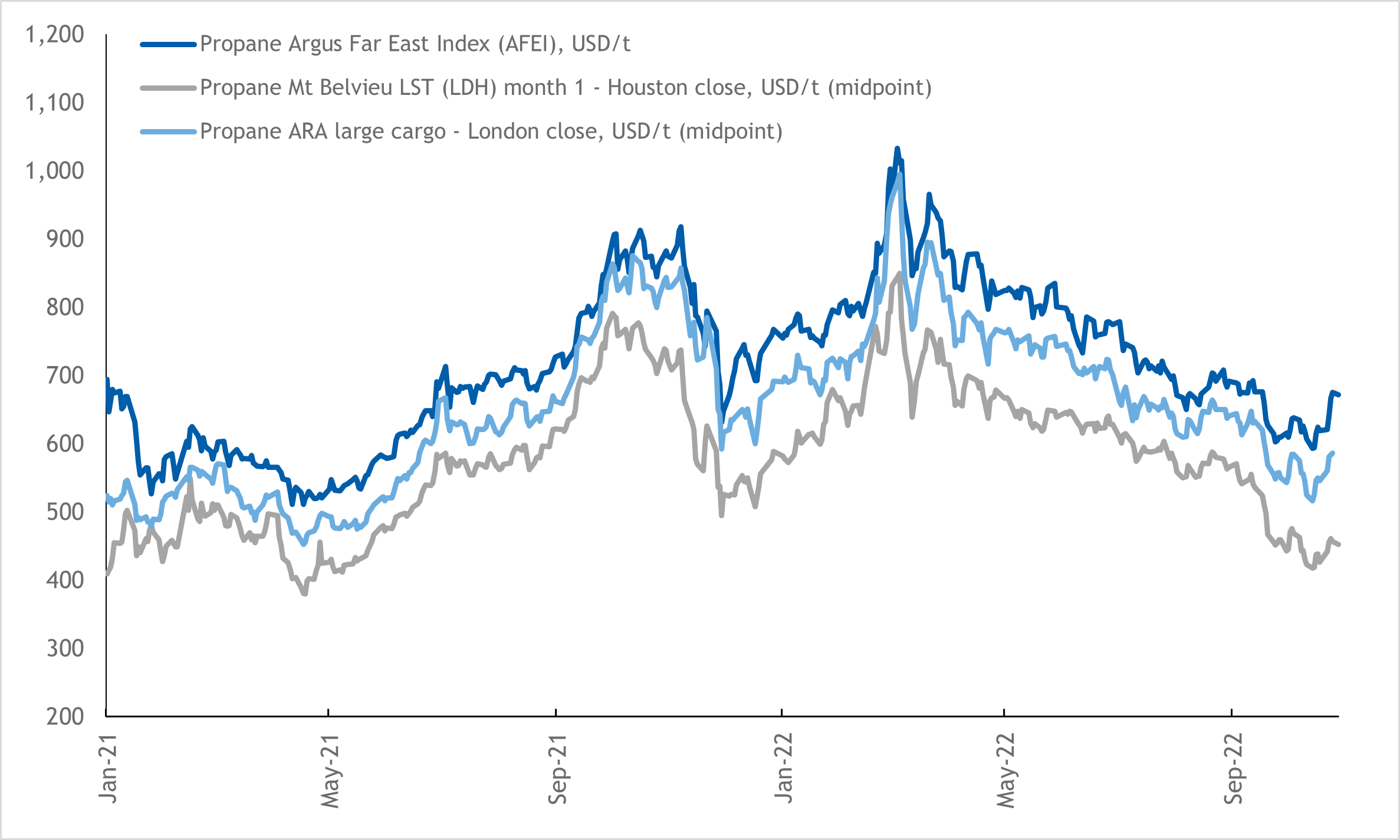

Asian prices staged a strong rally in late-October, outpacing gains in the crude benchmarks. The Argus Far East Index (AFEI) settled at $672/t on 31 October, up 9pc from the start of the month, while front-month Brent values increased by 6.6pc. Cash differentials for propane cargoes delivered to Japan in November moved into positive territory from discounts of $8/t, following renewed demand from China after the Golden Week holidays.

Click here to enlarge

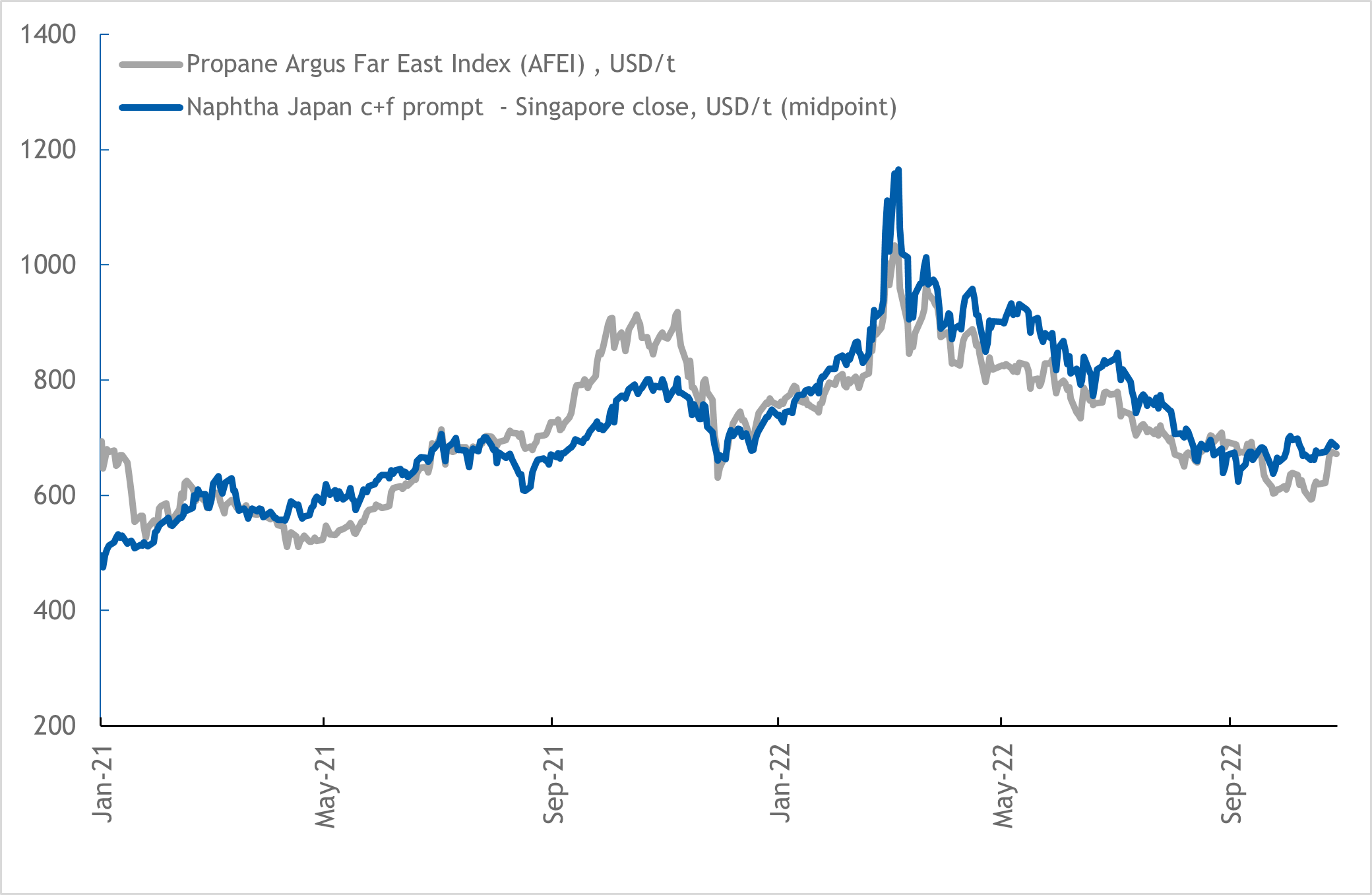

Owing to relatively weak propane prices during the summer months, front-month AFEI swaps values averaged a discount of $49.5/t over its naphtha equivalent in October which spurred demand from ethylene makers. A Taiwanese cracker procured 46,000t propane for first-half November delivery at $67/t discount to November naphtha quotes.

But a surge in propane demand from the petrochemical sector in China pushed LPG prices to near-parity to naphtha by the end of the month.

Click here to enlarge

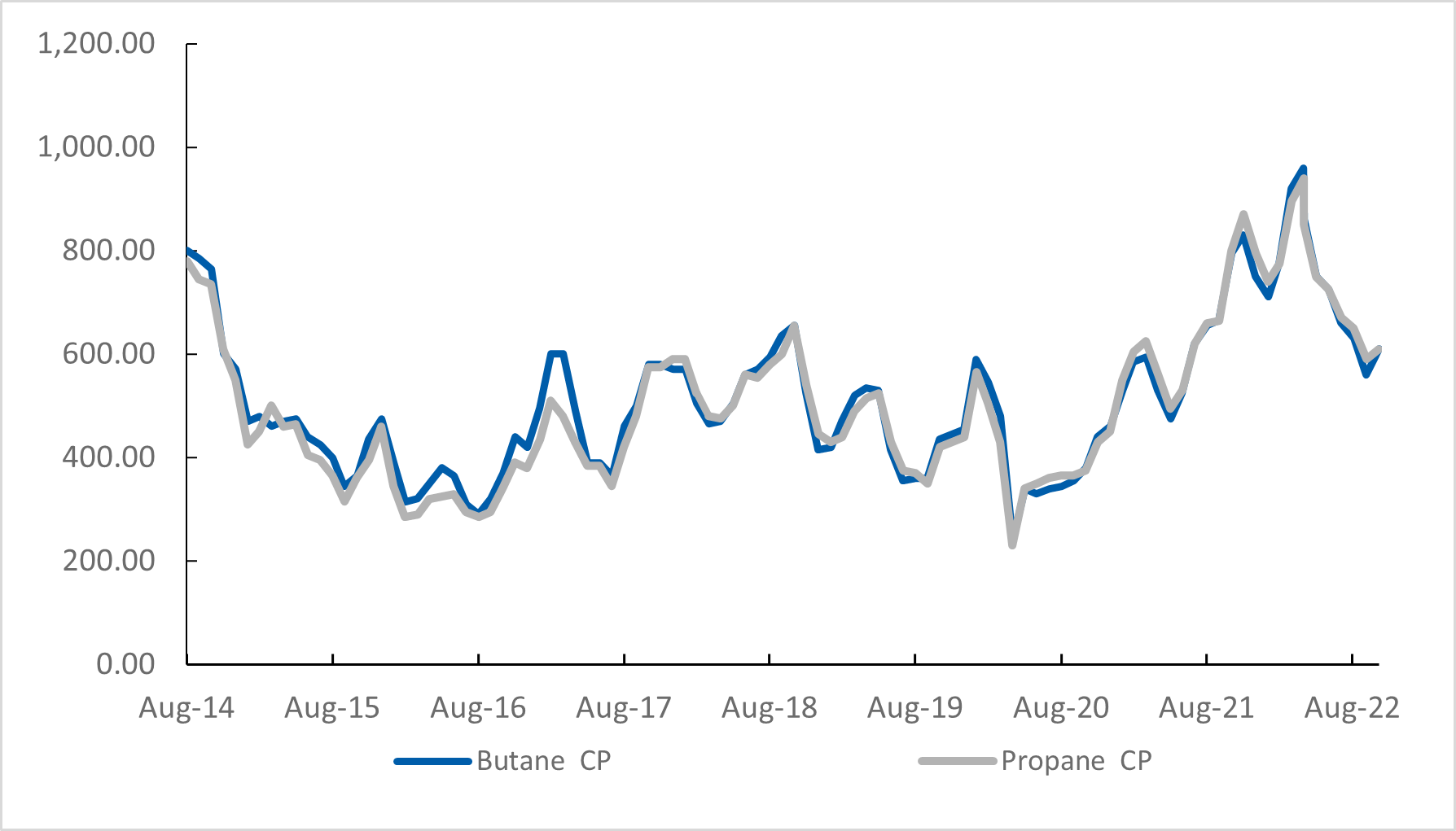

Saudi Arabia’s state-controlled Saudi Aramco raised the November propane and butane Contract Prices (CP) by $20/t and $50/t respectively from October to $610/t for both grades to reflect rebounding crude prices. Tightening availability of butane-heavy cargoes pushed butane to parity with propane compared to a $30/t discount the month prior.

Click here to enlarge

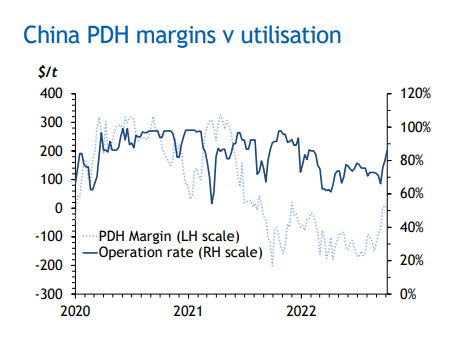

The average operating rates at Chinese PDH producers jumped from 66pc on 21 September to 80pc on 5 October amid improving production margins.

Increased production from PDH plants in addition to new start-up ones have expanded propylene supply which would exert downward prices on downstream yields.

Neque porro quisquam est, qui dolorem ipsum quia dolor sit amet, consectetur, adipisci velit, sed quia non numquam eius modi tempora incidunt ut labore et dolore magnam aliquam quaerat voluptatem.

Ipsum ut perspatis unde omnis iste natus error sit volupta tem accus antium dolor emque lantim aperiam.

Ipsum ut perspatis unde omnis iste natus error sit volupta tem accus antium dolor emque lantim aperiam.

Ipsum ut perspatis unde omnis iste natus error sit volupta tem accus antium dolor emque lantim aperiam.

Above average temperatures across Europe have delayed the start of heating season, tamping down regional propane demand. Despite this, outright propane prices have been on an upward trend, driven by gains in crude rather than by LPG specific dynamics.

Cracking economics point to both propane and butane offering better returns than naphtha. But overall weakness in the petrochemicals sector has been keeping cracker run rates on the low side. While this appears to have stabilised, few expect to see a sustained recovery in the short term.

So, although imports from the US have slowed, there is little sense that northwest Europe is short of product even though local production has been eroded by a year of dramatically high natural gas prices. And high US stocks combined with rising US LPG production has assuaged fears that recovering Asian demand might leave Europe short of US supplies.

The same mild weather and high stocks that are weighing on propane have also caused prompt natural gas prices to collapse in the last week of October, dropping back below LPG. As a result, more refinery LPG is emerging. The premium for downstream railcar prices compared to large cargoes has narrowed fromover $200/t in early October to less than $100/t. However, the natural gas forward curve suggests that the present weakness is unlikely to last and refinery supply to the market is still far short of where it would usually be.

Neque porro quisquam est, qui dolorem ipsum quia dolor sit amet, consectetur, adipisci velit, sed quia non numquam eius modi tempora incidunt ut labore et dolore magnam aliquam quaerat voluptatem.

Ipsum ut perspatis unde omnis iste natus error sit volupta tem accus antium dolor emque lantim aperiam.

Ipsum ut perspatis unde omnis iste natus error sit volupta tem accus antium dolor emque lantim aperiam.

Neque porro quisquam est, qui dolorem ipsum quia dolor sit amet, consectetur, adipisci velit, sed quia non numquam eius modi tempora incidunt ut labore et dolore magnam aliquam quaerat voluptatem.

Lorem ipsum dolor amet consetur adiisicing elit, sed eiusmod tepor magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation cupidatat non proident, sunt in culpa qui officia mollit.

Find out moreLorem ipsum dolor amet consetur adiisicing elit, sed eiusmod tepor magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation cupidatat non proident, sunt in culpa qui officia mollit.

Find out moreLorem ipsum dolor amet consetur adiisicing elit, sed eiusmod tepor magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation cupidatat non proident, sunt in culpa qui officia mollit.

Find out moreLorem ipsum dolor amet consetur adiisicing elit, sed eiusmod tepor magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation cupidatat non proident, sunt in culpa qui officia mollit.

Find out moreNeque porro quisquam est, qui dolorem ipsum quia dolor sit amet, consectetur, adipisci velit, sed quia non numquam eius modi tempora incidunt ut labore et dolore magnam aliquam quaerat voluptatem.

Lorem ipsum dolor amet consetur adiisicing elit, sed eiusmod tepor magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation cupidatat non proident, sunt in culpa qui officia mollit.

Find out moreLorem ipsum dolor amet consetur adiisicing elit, sed eiusmod tepor magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation cupidatat non proident, sunt in culpa qui officia mollit.

Find out moreLorem ipsum dolor amet consetur adiisicing elit, sed eiusmod tepor magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation cupidatat non proident, sunt in culpa qui officia mollit.

Find out moreLorem ipsum dolor amet consetur adiisicing elit, sed eiusmod tepor magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation cupidatat non proident, sunt in culpa qui officia mollit.

Find out moreNeque porro quisquam est, qui dolorem ipsum quia dolor sit amet, consectetur, adipisci velit, sed quia non numquam eius modi tempora incidunt ut labore et dolore magnam aliquam quaerat voluptatem.

Ipsum ut perspatis unde omnis iste natus error sit volupta tem accus antium dolor emque lantim aperiam.

Ipsum ut perspatis unde omnis iste natus error sit volupta tem accus antium dolor emque lantim aperiam.

Ipsum ut perspatis unde omnis iste natus error sit volupta tem accus antium dolor emque lantim aperiam.

Neque porro quisquam est, qui dolorem ipsum quia dolor sit amet, consectetur, adipisci velit, sed quia non numquam eius modi tempora incidunt ut labore et dolore magnam aliquam quaerat voluptatem.

Ipsum ut perspatis unde omnis iste natus error sit volupta tem accus antium dolor emque lantim aperiam.

Ipsum ut perspatis unde omnis iste natus error sit volupta tem accus antium dolor emque lantim aperiam.

Ipsum ut perspatis unde omnis iste natus error sit volupta tem accus antium dolor emque lantim aperiam.

Neque porro quisquam est, qui dolorem ipsum quia dolor sit amet, consectetur, adipisci velit, sed quia non numquam eius modi tempora incidunt ut labore et dolore magnam aliquam quaerat voluptatem.

Conway propane is presently very near parity with Mont Belvieu, Texas. Stocks in the midcontinent US are lower than they normally might be as there was a fire at the 210,000 b/d Medford, Oklahoma fractionator in July, which has forced those volumes south to fractionators at Mont Belvieu, Texas. Currently US exports remain very strong but interest for incremental spot loading fob cargoes has been stymied by delays at the Panama Canal, which is pushing freight higher and leaving all but term buyers on the sidelines at the moment.

The December arbitrage to Asia on paper is very wide –over $200/t versus Mont Belvieu, but freight and demurrage costs around the canal, where southbound waiting times extended to 20 days this week, is hampering activity. Spot terminal fees rose this week, to 6-6.5¢/USG owing to the wider arbitrage to Asia, but no deals have been reported. Loadings out of the Targa export terminal were delayed due to a mechanical issue at one of the docks the week of October 20; while that has been resolved, it caused further delays and shipping headaches for US exporters.

Neque porro quisquam est, qui dolorem ipsum quia dolor sit amet, consectetur, adipisci velit, sed quia non numquam eius modi tempora incidunt ut labore et dolore magnam aliquam quaerat voluptatem.

|

|||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||