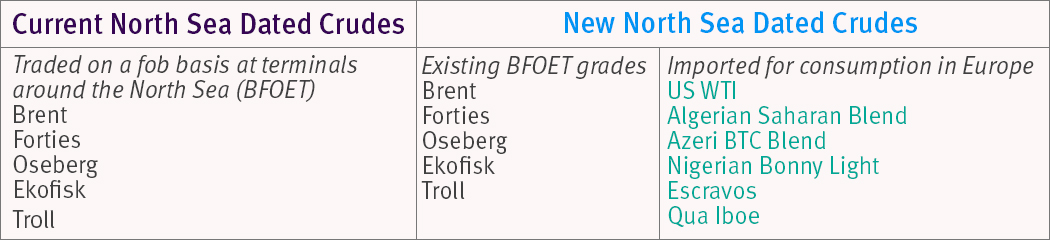

The new price index is based on a robust methodology that combines the liquidity of the existing market for North Sea crudes with a range of delivered Rotterdam assessments of other crudes regularly consumed in Europe.

The North Sea market provides the price benchmark for much of the crude traded around the world, including exports from Russia, Africa, Latin America and the Middle East (to Europe) and deliveries into Asia.

The disruption to the Forties pipeline in late 2017 and the increasing removal of benchmark-grade Forties from the North Sea market for shipment to Asia has left the market appearing short, illiquid and volatile. However, there is a large and growing volume of similar light, sweet crude available to European refiners, especially from the US.

The market requires a regional European benchmark that reflects the new reality. Argus is the first to introduce a fully formed new methodology that builds on the strengths of the existing market, while incorporating new market reality. Today, delivered grades are just as likely to provide the clearing price signal.

As North Sea production declines and European refiners look for alternative sources of crude, the volume of US WTI crude refined in Europe (around 900,000 b/d) is expected to surpass the combined production of all North Sea BFOET grades (currently 910,000 b/d). US WTI crude is the most competitively priced light, sweet grade in the European market and should be part of the benchmark-setting process.

We also include other similar-quality grades that are regularly delivered to Europe — Saharan Blend, BTC Blend, Bonny Light, Escravos and Qua Iboe — to increase liquidity and allow for more participation in the benchmark-setting process.