Commodity risk managers face many challenges in today’s complex and fast-moving markets – regulatory compliance, market volatility, geopolitical developments and data accessibility to name a few.

Argus forward curves represent an independent assessment of market value for forward contracts and financial swaps. By using them, risk managers can enhance their ability to predict, monitor and mitigate risks, ultimately leading to improved decision-making and operational efficiency.

Complete the form to request a personalised demonstration and learn how Argus forward curves support your risk management processes.

Argus Data Scientists will deliver a personalised demonstrations of our risk management solutions tailored to your requirements.

Commodity risk managers across the globe use Argus forward furves to develop effective hedging strategies and to support their risk management practices.

Use Argus forward curves as benchmarks to evaluate the fair value of commodity transactions and portfolios. Ensure your trading and risk management practices are supported with accurate market data.

Develop robust hedging strategies by identifying price exposure points across different maturities. Argus forward curves help you reduce the impact of market volatility, safeguarding your company’s financial health.

Conduct thorough risk assessments and stress test your portfolios under various market conditions. Argus forward curves facilitate advanced scenario planning, helping you anticipate and manage risks effectively.

Use Argus forward curves as benchmarks to evaluate the fair value of commodity transactions and portfolios. Ensure your trading and risk management practices are supported with accurate market data.

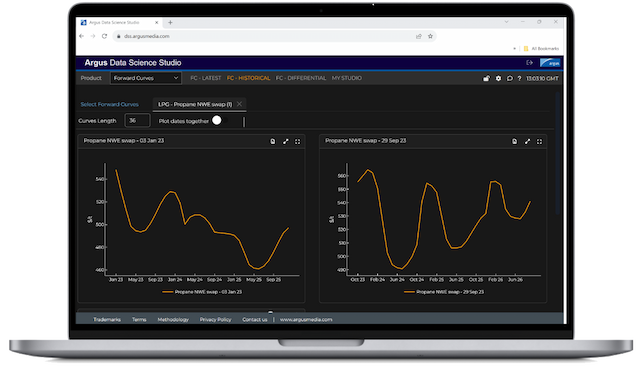

Enhance your insights with the Argus data science studio. Visualise and analyse forward curve data, customise the curves and perform scenario analysis to improve your decision-making and operational efficiency.

Argus forward curves offer independent price assessments based on robust methodologies, ensuring you meet regulatory standards and provide senior management with peace of mind.

Key crude grades across the Americas, Europe and Asia-Pacific

Gasoline, diesel, fuel oil, heating oil, VGO, jet fuel, naphtha and asphalt

FAME, UCO, UCOME, SAF, HVO, ethanol, tallow, soya, rapeseed and more

Forward prices at more than 80 locations across North America

All the major electricity and trading hubs across North America

The Argus data Science Studio makes forward curves more powerful than ever before. Through our sophisticated algorithms, comprehensive data and robust methodologies, you can build and calculate your own curves, unique to your business. Let the Argus Data Science Studio do the hard work.