Asia & Middle East

Global propane prices

Delivered Japan propane prices rebounded by 5.8pc in May from a month ago after a temporary pause in the US-China trade war led to lowered tariffs on US imports into China which rendered US LPG competitive for the Chinese market.

China’s LPG imports from the US dipped to 980,000t in May compared to the six-month roll average 1.4mn t before the eruption of trade war disrupted flows from China’s single largest supply source.

Spot sales on 46,000t propane 1h July delivery to Ningbo were concluded at $17-18/t premium to July Argus Far East Index (AFEI), excluding import tax imposed by the Chinese government, while similar cargoes for delivery to Japan were at July AFEI +$8-9/t.

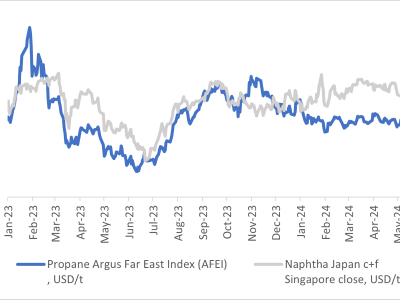

LPG versus naphtha

The monthly average front-month propane swaps narrowed to $32/t discount to its naphtha counterpart in May compared to -$51/t in April owing to renewed strength in the LPG complex.

Regional crackers slowed down spot purchases on propane though Hanwha Total procured butane owing to a nearly $20/t discount on the heavier grade.

Ample supply of butane in the Mideast Gulf region saw evenly split ratio cargoes loading in June changed hands at the equivalent of $60-70/t discount to June CP.

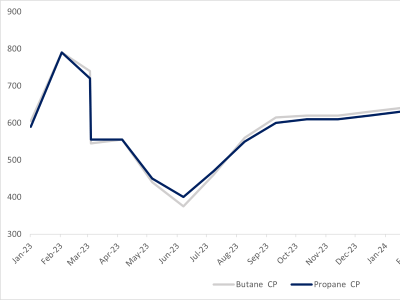

Saudi Aramco posted Propane & Butane CP

Saudi Arabia’s state-controlled Saudi Aramco lowered the June propane Contract Prices (CP) by $10/t month-on-month to $600/t. Its butane counterpart lowered by $20/t to $570/t. Additional supply of evenly split ratio cargoes from the US had augmented supply to the Asian market in June which weighed down butane values.

Spot offerings on butane-heavy cargoes from Qatar and Kuwait compounded the butane oversupply situation which led to the widening of June propane-butane CP spread to $30/t from $20/t last month.

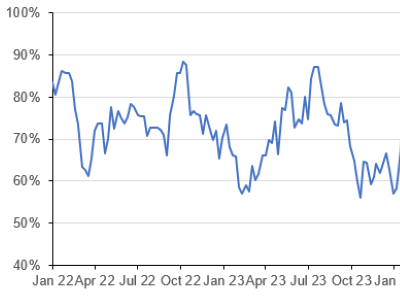

Chinese PDH performance

Run rates at Chinese PDH plants rose to 68pc at the end of May compared to 66pc in end-April after some units returned from maintenance.

Fujian Zhongjing Petrochemical commenced operations at its third PDH in mid-May. The 900,000t/yr unit achieved on-specification in mid-May and reached 80pc run rate by end-May.

- Argus International LPG

Europe

The large cargo cif Amsterdam-Rotterdam-Antwerp (ARA) propane sentiment remained bearish during the full month of May and the outright price of the assessment did not manage to breach the $400/t territory.

Continuous public offering, which was mostly left unmet, placed downwards pressure on the lighter grade market, and the price dipped by $20/t to hit a low of $436.50/t in the first week of May. In the weeks after, when offering came to halt for a few days, the value bounced back slightly to a high of $482.25/t, before dipping to $437.50/t at the end of May.

Meanwhile the physical differential to front-month cif ARA paper plummeted into the negative territory to a low of -$13.50/t by the end of the month from a positive +$9/t at the beginning of May.

Demand for propane remained erratic while supply was much more consistent. Nevertheless, the region was still structurally short, with elevated natural gas prices capping the North Sea output.

Scant local availability forced European buyers to turn west to secure product from the US. In the full month of May, a total of 690,000t of US product made its way to northwest European shores, some 4pc above April’s total at 654,000t and nearly 50pc more than May 2024’s 470,000t, latest data from Kpler shows.

On butane, the large cargo market was mostly muted publicly and privately. The value as ratio relative to naphtha paper shed one-percentage point to 85.5pc towards the end of May compared to 86.5pc at the start of the same month, while the outright value of the heavier grade shed nearly $20/t to $443/t from $462.50/t over the same timeframe.

View chart >>

- Argus International LPG

Americas

US propane exports slowed in May, falling to 1.7mn b/d, or 4.2mn t, versus 1.9mn b/d (4.6mn t) seen in April, but still stronger than the 1.6mn b/d (4mn t) shipped in May of 2024, according to Kpler data. Butane exports surged to 561,000 b/d, or 1.6mn t, up from 410,000 b/d, or 1.1mn t, in April and up from 498,000 b/d (1.4mn t) seen in May 2024.

The more sedate pace of propane shipments followed a tumultuous April, with the US and China stepping back from the trade war, issuing a 90-day reprieve from tariffs on imported goods and feedstock. At the same time, traders seeking to swap split cargoes from the Middle East with US-origin LPG, as they diverted vessels from other destinations to China led to higher volumes of US butane loaded.

The additional export demand for butane bolstered prices at Mont Belvieu, Texas. Prompt-month EPC butane averaged 60.1pc of Nymex WTI in May, up from 44.3pc of crude last year, as butane lagged weakness in WTI. LST propane’s percentage of crude averaged 51.6pc in May, up from 37.7pc in 2024.

The arbitrage to Asia for propane remained relatively tight compared to VLGC freight, however, as spot terminal fees for incremental cargoes sold on the US Gulf coast remained discussed between Mont Belvieu +4.625-+6¢/USG during the month.

While US producers and terminal operators enjoyed a reprieve from propane tariffs, the outlook for ethane and butane turned more bearish at the end of the month. At the end of May, Enterprise Products Partners disclosed it had received a letter from the US Department of Commerce instructing the company to apply for an export license for ethane and butane. Ethane shipments to China from Enterprise’s Morgan’s Point, Texas, export terminal have ceased since the disclosure, according to Kpler tracking. Market participants remain puzzled, however, as it appears Enterprise is the only company to receive such a letter, and rival Energy Transfer, which exports the bulk of US ethane to China, is continuing to operate as normal. Energy Transfer has not replied to requests seeking clarification on the matter.

US ethane prices at Mont Belvieu, Texas, remained strong in May, averaging 24.57¢/USG during the month, up versus 19.42¢/USG last year.

- Argus NGL Americas

Outlook: The quarter ahead

- US-China tariffs may be reduced, but their impact is still being felt in the market

- Chinese and Middle Eastern LPG prices are at a premium to the rest of the world due to Chinese preference for non-US cargoes. But this premium has reduced from when the tariffs were first introduced

- Weak summer demand and rapidly building US inventories should keep pressure on prices

- The start of the Nederland terminal expansion should increase the availability of US exports

- The trade talks between the US and China and a key uncertainty moving forward

The next 6 months and longer term

- Even if an agreement is reached to remove barriers on LPG trade between the US and China, we expect the disruption to remain for several months as uncertainty persists

- Middle East supply will begin to ramp up, pressuring prices as we approach 2026

- Large amounts of naphtha cracking capacity is coming in China later this year, which could pressure LPG consumption in other NEA crackers

Israel attack on Iran

The latest issue of the Argus LPG Outlook was written and published before Israel launched its attack on Iran. As a result the forecast and commentary do not reflect this event but below some thoughts as of Monday 16th of June:

- There is minimal damage to Iranian LPG infrastructure, with only a single train at the South Pars phase 14 being hit. This translates to a loss of supply of around half a VLGC a month

- Although LPG production facilities are small and numerous, exports travel through a few large terminals. If these become damaged, Iranian exports could leave the LPG market quickly

- Iran exports around 800,000 t/month of LPG, mostly to China. Since the tariff war with the US, China has increasingly relied on Iranian supplies. If this trade is interrupted, it could cause even more shortages for the world’s largest importer

- The closure of the Strait of Hormuz is looking unlikely, but it would have a huge impact on the LPG market globally. Over 2.5mn t/month of LPG flows through the strait to Asia, for a sense of scale that is double Europe’s monthly imports

- If we see Middle East exports to Asia restricted, then the US will be the main source to replace these volumes. This will likely divert supply away from Europe, raising prices globally

- Argus LPG Outlook

Argus LPG Services

This information comes from our suite of regular LPG market services. For daily prices and market commentary: Argus LPG International and Argus NGL Americas. For regular, detailed market insights: Argus LPG World. For forecasts on prices and market fundamentals: Argus LPG Outlook and Argus Analytics – LPG Service.

If you have been forwarded this newsletter and would like to receive the next issue, sign up.

Talk to us!

For more information on our LPG solutions and market coverage, learn more here.

Alternatively, talk directly to us, fill in the form, and we will be in touch with you.