India thermal coal imports reach all-time high

13 Nov 18, 13:22 - Coal, Steam coal

London, 13 November (Argus) — India's thermal coal imports reached an all-time high in October after utilities increased their call on seaborne product amid year-on-year increases in coal-fired power generation and a shortfall in domestic deliveries.

India increased imports by 3.6mn t on the year to 16.9mn t in October, according to shipping data. Imports were up by 2.3mn t on the month.

Arrivals from Indonesia made up 69pc of the receipts in October, as delivered-India prices for Indonesian GAR 4,200 kcal/kg and GAR 5,000 kcal/kg coals undercut other origins after reaching a year low in September, according to Argus calculations.

Utilities took advantage of competitively priced Indonesian coals to replenish plant stockpiles as electricity demand increased and domestic coal production continued to miss output targets.

Several coal plants in the country have stocks equivalent to a maximum of just seven days of use, threatening to disrupt thermal power generation.

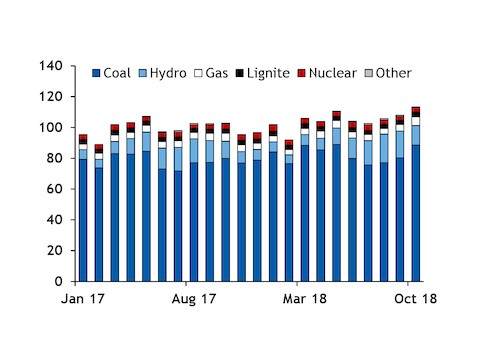

Demand for power reached an all-time high as Indian economic activity expanded by 8.2pc in July-September, underpinning growth in coal-fuelled generation — while other types of thermal generation shrank on the year.

India produced a higher-than-forecast 113.3TWh of electricity in October, up by 10.5TWh. This equated to growth of 10pc on the year and 4pc ahead of energy ministry expectations of 109.3TWh.

Most of the growth was met by higher coal-fired generation, which increased by 8.7TWh or 11pc on the year to 88.6TWh, and hydro, which increased by 3.3TWh or 13pc to 12.6TWh.

The growth in power demand took total power output in January-October to 1,046TWh, a shade higher than the 1,030TWh generated in the same 10 months last year, while coal-based generation grew by 5.4pc to 825TWh from 782TWh over the same period.

This level of power generation implies that India's coal-fired power plant fleet was operating at around 60pc. Power utilities would require around 550mn t of GAR 4,200 kcal/kg coal to generate 825TWh.

Between January and October, Coal India (CIL) has delivered a little under 500mn t of coal to its domestic customers — 490mn t run-of-mine, plus 10mn t from stockpiles. Of this total around 85pc would have been dedicated to power plants and the remainder to industrial clients.

This implies that utilities would have taken at least 425mn t from CIL, forcing utilities — private and state-run — to source higher-calorific value (CV) coal from the seaborne market.

Indian state-owned utility NTPC issued its largest coal import tender in three years in August, highlighting the shortfall in domestic coal availability.

NTPC had all but stopped using imported thermal coal because of a government drive to push state-run utilities to use more domestic supplies. But the firm sought 2.5mn t of coal for delivery over four months.

Infrastructure cements demand for coal

Meanwhile, demand from the infrastructure sector soared, with an increase in activity following the monsoon season, and competitive coal prices compared with petroleum coke.

Heavy monsoons caused damage in some Indian regions, and state governments are now funding projects to repair buildings and roadways.

There is also a push from the central government to expand public infrastructure projects throughout the country before national elections in April 2019.

Coal priced in cheaper than petroleum coke in August and September, when cargoes for October arrival would have been booked.

Just 147,000t of fuel-grade petroleum coke reached India in October, the lowest import total in more than three years.

Meanwhile, imports of Australian and Russian coals grew in October to make up the coke shortfall. Australian thermal coal receipts neared July's all-time high at 1.1mn t. This was over two-and-a-half times the volume imported in October 2017.

Russian imports stood at 309,600t, the highest receipts since July 2016.

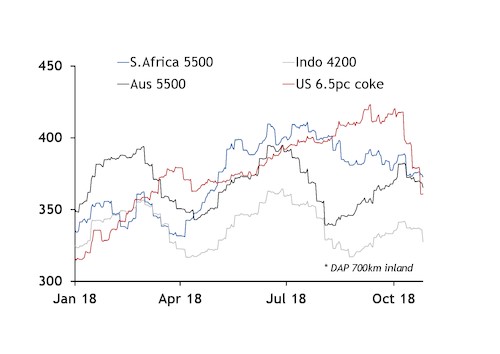

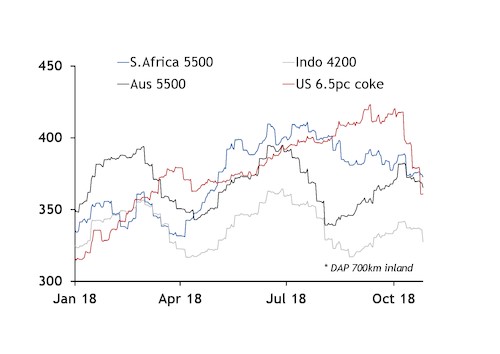

US high-sulphur coke averaged around Rs410/mn Btu during August-September on a delivered-at-place (dap) basis, while Australian NAR 5,500 kcal/kg coal priced at Rs353/mn Btu.

Delivered India solid fuel costs Rs/mn Btu

India power generation TWh

Want daily coverage of the coal market?

Argus daily reports cover major price indexes such as ICI4, API2, and more. Our reports and prices are available on Argus Direct, via desktop and mobile application platform.

Argus Coal Market Services

|

ARGUS Coal Daily International

Your source of International price assessments featuring prices such as cfr South China, fob Newcastle and more. |

|

|

ARGUS Coalindo Indonesian Coal Index Service

The leading coal price reference used by traders of Indonesian coal featuring price indexes ICI1, ICI2, ICI3, ICI4 and ICI5.

|

|

|

ARGUS McCloskey's Coal Price Index Service

Used by professionals globally, with more than 90pc of the world’s traded coal derivatives using the API 2 and API 4 indexes.

|

To read the other stories, click on the links below:

To read the other stories, click on the links below: