South Korean coal burn drops in September

20 Nov 18, 13:42 - Coal, Steam coal, Fundamentals, Demand

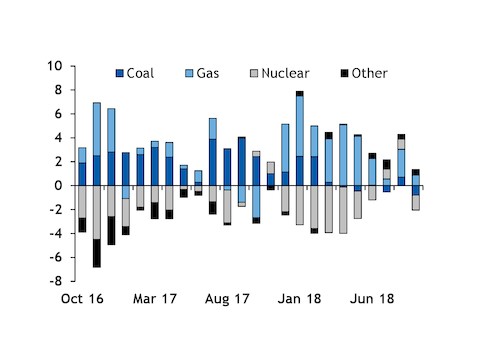

London, 20 November (Argus) — South Korean coal-fired power generation recorded its biggest annual decline since April 2016 in September, as plant restrictions continued to hamper output.

The South Korean coal fleet supplied 19.8TWh to the grid in September, state-owned utility Kepco data show, which was down by 736GWh from 20.6TWh in the same month last year.

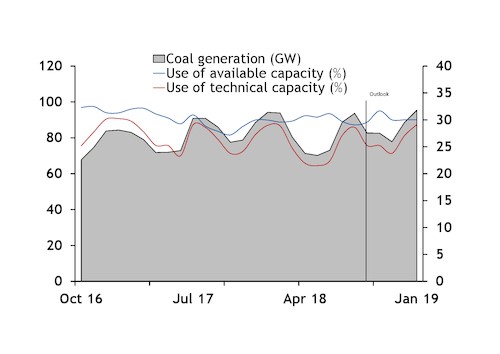

Coal capacity restrictions totalled 5.32GW in September, the Korea power exchange said, leaving around 31GW of capacity available for generation in September. On this basis, available capacity ran at a load of 89pc in September compared with a January-September average of 90pc. Restrictions totalled 1.97GW in the same month last year, leaving 34.3GW of capacity available, which was run at an 83pc load.

Heavy restrictions on coal capacity means that the utilisation of South Korea's installed coal-fired capacity slumped to 76pc in January-September, from 82pc last year, although the start-up of new coal-fired plants in June-September 2017 has still helped to increase total coal generation by 2.4pc year on year to 181.4TWh in January-September 2018.

Coal restrictions are expected to have reached at least 7.4GW in October and should total at least 7.6GW in November and 3.7GW in December, which would yield 19.5TWh, 18.7TWh and 21.9TWh respectively, if run at a 90pc load. This would compare with an output of 19.2TWh, 18.9TWh and 21.9TWh in October, November and December 2017.

But available capacity was probably run at more than a 90pc load in October, as unseasonably cold conditions lifted power demand and coal imports year on year.

The outlook for limited growth in fourth-quarter coal burn because of planned restrictions means that utilities will be forced to call on gas-fired plants to meet any unseasonably strong spikes in power demand early this winter. Gas-fired generation rose year on year for a 10th consecutive month in September, gaining by 11pc to 8.8TWh. And gas-fired generation was 30pc higher on the year in the first nine months of 2018 at 115TWh.

The utilisation of South Korean gas-fired capacity averaged less than 50pc in January-September, despite the surge in output, meaning gas-fired plants remain well placed to offer additional supply flexibility in the months ahead.

Capacity restrictions have limited growth in coal-fired generation this year, so gas had to increase to cover both the loss of nuclear capacity and an increase in total power demand. Daily average peak power demand in South Korea was up by nearly 4pc year on the year in January-October at 71.2GW. Demand gained on the year in every month except September, when daily peak offtake fell by 1.3pc to an average of 66.4GW. The daily mean temperature in Seoul in the first 18 days of November has been 1.2°C higher than the 10-year average and daily peak demand was down nearly 1pc on the year at 66GW.

Nuclear generation fell by 1.3TWh year on year to 11.1TWh in September and was down by 17.8TWh or 15pc in January-September to 96.8TWh. Nuclear output was lower than expected because of outages and extensions to maintenance at several units. Based on the capacity availability data published by Korea Hydro and Nuclear Power, output is likely to be relatively stable at between 11.7-12.0 TWh/month in the fourth quarter, compared with an average of 11.3 TWh/month in the same time last year.

Coal faces obstacles to growth

Output is then set to rise more significantly year on year in the first quarter of 2019, when three reactors are due back from maintenance in January and a further two in early February.

Nuclear generation could therefore exceed 13TWh in both January and February, which would be a sharp increase from 9.8TWh and 8.8TWh in 2018, respectively, when nuclear disruption was most pronounced during the first quarter.

Coal restrictions are also expected to ease in January and February 2019, which should support coal burn at a similar level as at the start of 2018, when a record-high 23.4TWh was generated in January. The potential for greater coal and nuclear output early in 2019 could pressure gas burn during the peak winter demand months, but gas may then benefit from a potential change in tax regime from April and from the planned mothball of older coal-fired units between March-June 2019.

The South Korean government is due to approve its 2019 budget by early December, which is set to lower the fuel tax for LNG use and increase the levy due on coal burn. This would reduce coal's cost advantage over gas for thermal generation and could weigh on demand for seaborne imports as a result.

As well as trying to pare coal from the generation mix, South Korea is showing an increasing preference for low-sulphur coals in an effort to reduce fine dust emissions and improve air quality. Tender data collated by Argus show that utilities have demanded a lower maximum sulphur content when they have sought offers of seaborne coal since April this year. The volume-weighted average maximum sulphur content demanded in tenders was 0.78pc between January 2017-March 2018, but this has dropped to 0.47pc since April.

Year-on-year change in Korean generation TWh

Average max sulphur % demanded by Korean utilities %

South Korean coal output and capacity utilisation %, GW

Want daily coverage of the coal market?

Argus daily reports cover major price indexes such as ICI4, API2, and more. Our reports and prices are available on Argus Direct, via desktop and mobile application platform.

Argus Coal Market Services

|

ARGUS Coal Daily International

Your source of International price assessments featuring prices such as cfr South China, fob Newcastle and more. |

|

|

ARGUS Coalindo Indonesian Coal Index Service

The leading coal price reference used by traders of Indonesian coal featuring price indexes ICI1, ICI2, ICI3, ICI4 and ICI5.

|

|

|

ARGUS McCloskey's Coal Price Index Service

Used by professionals globally, with more than 90pc of the world’s traded coal derivatives using the API 2 and API 4 indexes.

|

To read the other stories, click on the links below:

To read the other stories, click on the links below: