New Features

Quarterly reports

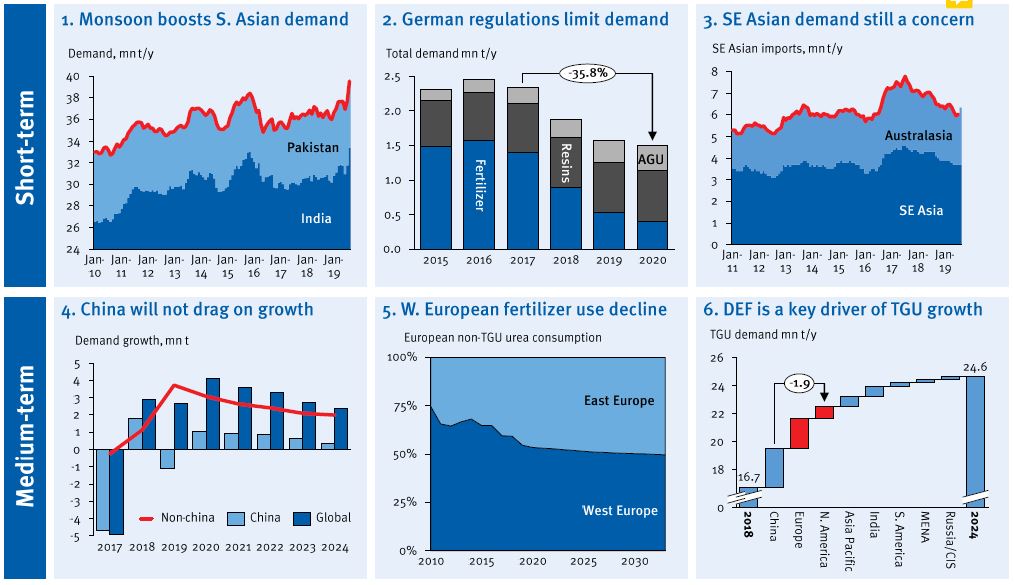

Fundamentals analysis

|

Focused on medium term and topical events. Access analysis of the impact of recent events on our view of future prices in a narrative and graphical way. Supply | Demand | Costs | Trade | Forecasts |Annual S/D forecast 15yrs History | 15yrs Forecast |

|

Price forecasts time horizons

|

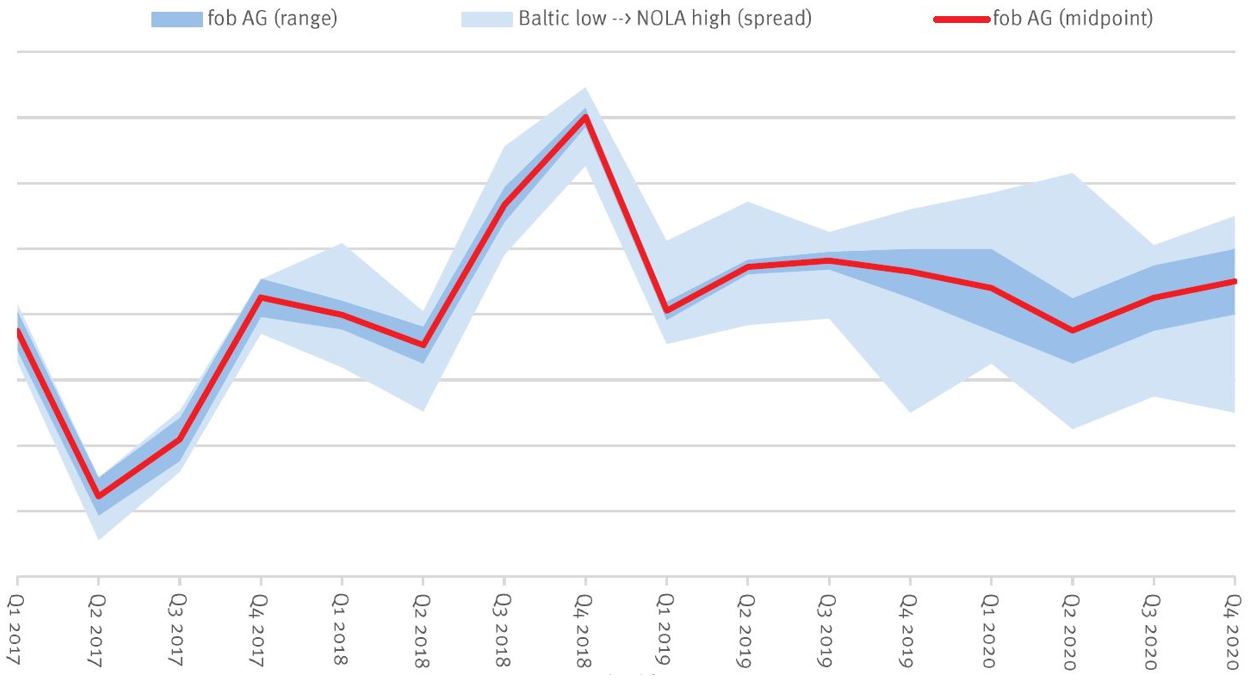

Horizon 1: Near-term focus for 12-18 months Variables driving prices include energy prices, crop prices, FX changes, and seasonal S/D and trade imbalances. |

|

|

|

|

||

|

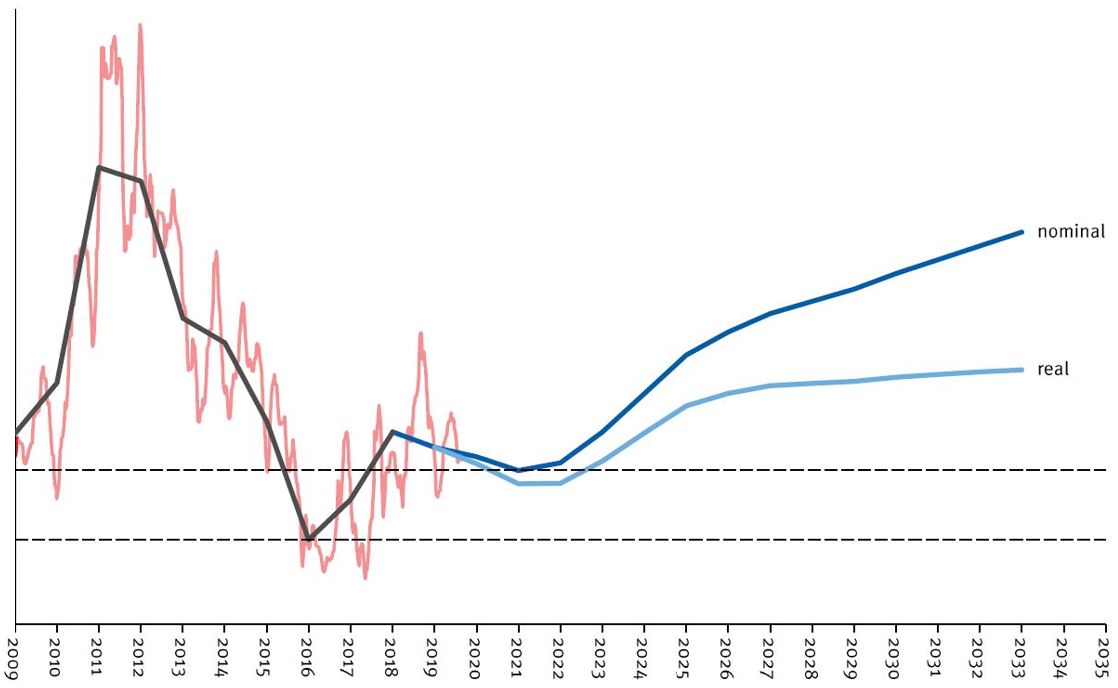

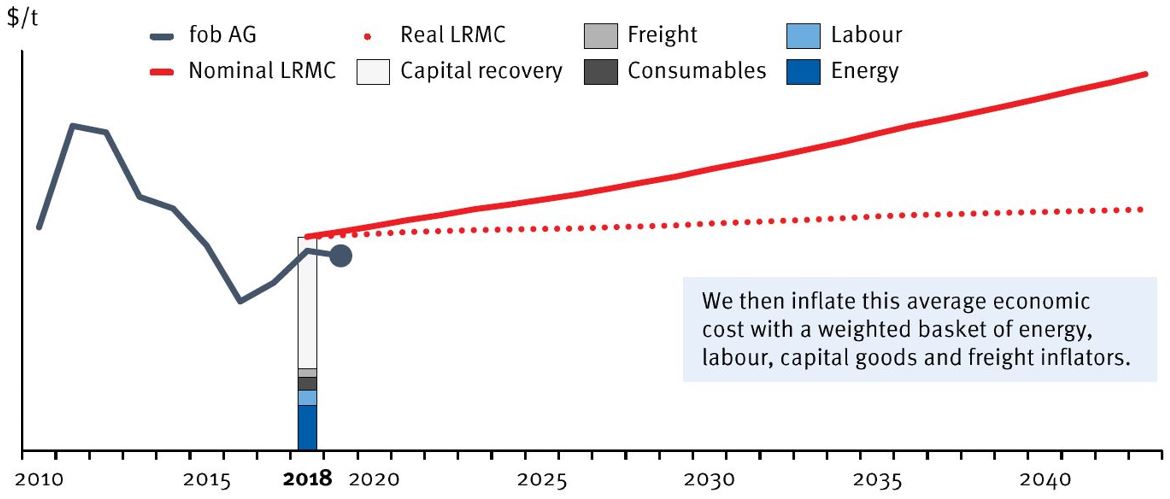

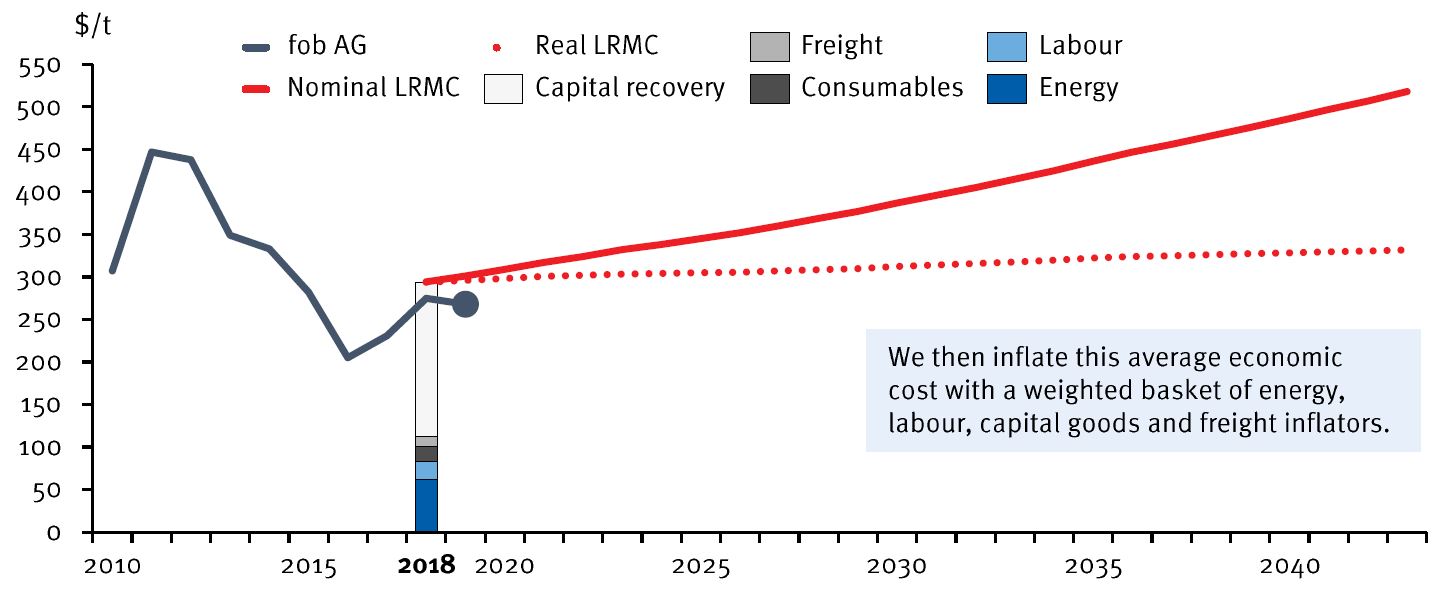

Horizon: Five-year cyclical outlook Driven by the investment cycle and other influences on the S/D balance. Beyond the investment cycle for plants or mines, we use a Long-Run Marginal Cost (LRMC) model to predict price levels required to incentivise investment in new capacity. A statistical mean reversion model is used to connect the medium and long term forecast. |

|

Production cost analysis

|

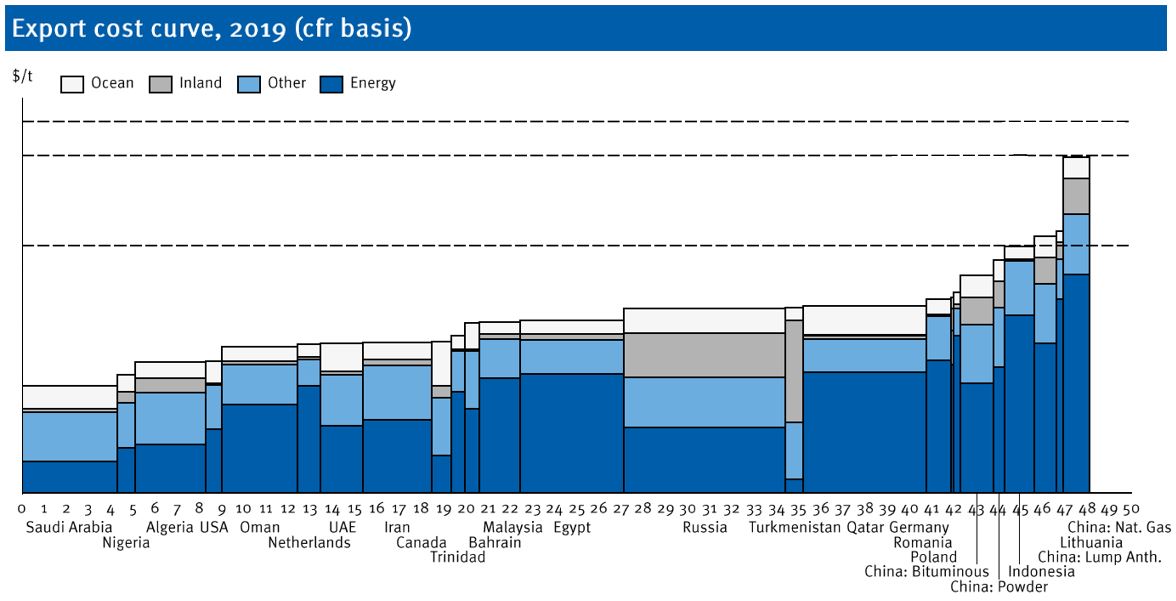

Cost Curves Access country-level cost curves (and in some cases plant-level costs) to export fob or global benchmark location. This allows us to focus on marginal producers and their impact on price formation to balance the market. |

|

|

|

|

||

|

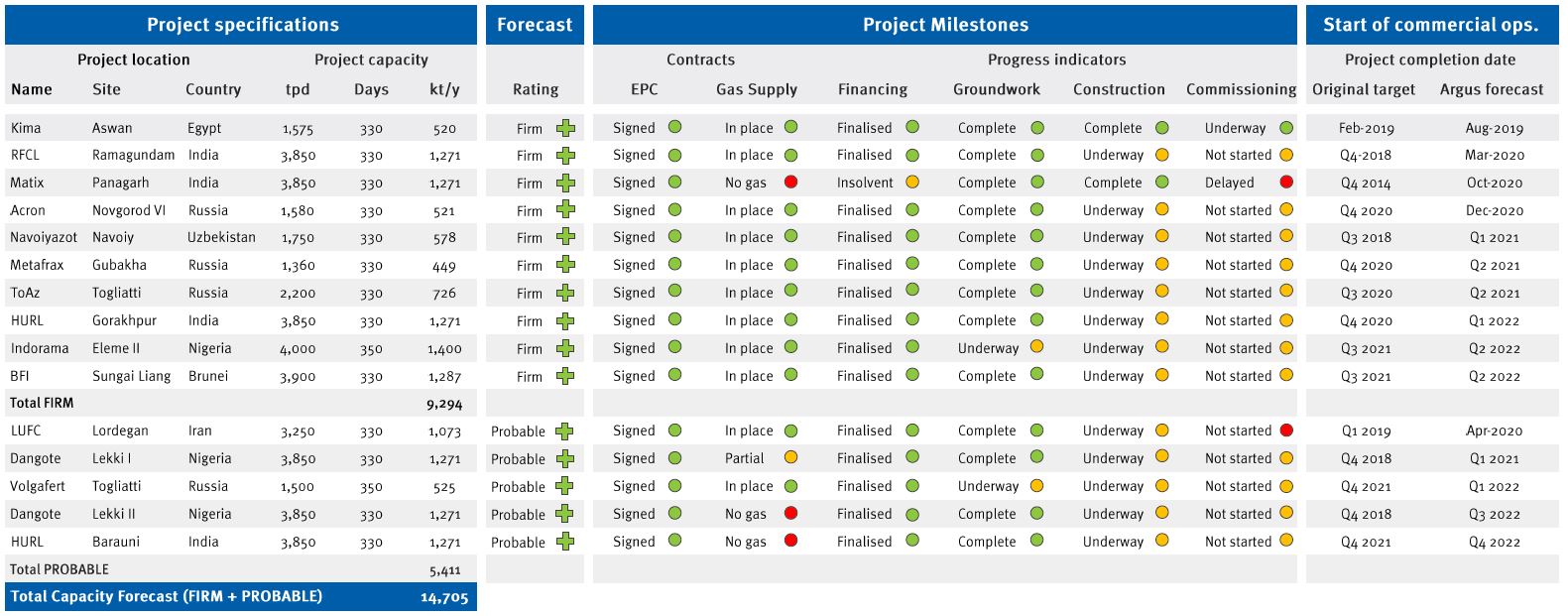

Project screening Project progress is assessed using a traffic light system for development milestones, categorising as Firm, Probable, Possible and Speculative (along with forecast of startup date). Where appropriate, deep dives into especially influential projects are provided, including full economic cost build up, position on cost curve, NPV heat map and DCF forecast. |

|

Annual report

Fundamentals analysis

|

Focused on changes to long term trends Overview of market fundamentals | Long run supply trends and gaps | Long run demand forecast driven by diet changes, and calorie consumption and food production projections | New formulations Long term efficiency improvements| 15yrs History | 15yrs Forecast of demand, supply and trade |

|

Price forecasts time horizon

|

25 year price forecast Based on our Long Run Marginal Cost (LRMC) model. LRMC methodology is independent from Supply/Demand allowing us to forecast further ahead (for strategy definition and investment cash flow modelling purposes) 25yr LRMC forecast updated annually |

|