India’s December coal receipts slow

10 Jan 19, 13:22 - Coal, Steam coal, Fundamentals, Demand

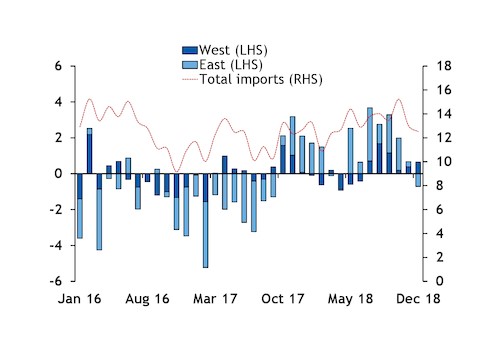

London, 10 January (Argus) — India's thermal coal imports in December fell year-on-year for the first time in eight months, after 2018 receipts surged as buyers turned to seaborne markets amid domestic supply shortages.

Provisional data from the 31 Indian ports sampled by electronic commerce firm Mjunction slipped by 153,000t year on year to 12.52mn t last month — the first decline since April. In contrast, arrivals over May-November increased year-on-year by an average of 2.09mn t/month.

Declines were led by Krishnapatnam and Paradip ports, where imports were down by 677,400t and 605,400t, respectively, to 1.22mn t and 466,400t in December. East coast ports imported 5.54mn t in December, down by 710,100t in the first year-on-year fall since April. Last month's receipts also slipped from 13mn t in November 2018.

Imports to west coast terminals rose for a sixth consecutive month by 640,900t year on year to 6.98mn t last month. Gujarat state's Mundra port took 2.46mn t in December, up by 274,700t year on year. Adverse weather interrupted some port operations, as cyclone Phethai made landfall in Andhra Pradesh state in mid-December.

Imports rebound in 2018

Thermal coal imports rose to a three-year high of 158.54mn t last year, rising by 16.12mn t, or 11.3pc, from 2017.

Imports over the second half of the year — reaching 82.03mn t — outpaced arrivals over the first six months of 2018 — peaking at 15.23mn t in October, according to e-commerce company Mjunction. West-coast imports accounted for 54.7pc of last year's total compared with 59.3pc in 2017 — even as outright volumes gained by 2.35mn t year on year in 2018.

Increased seaborne demand from state-operated power plants and federal government-operated utility NTPC supported growth. Indian state-controlled utility Tamil Nadu Generation and Development Corporation opened a tender for imported thermal coal in September 2018 because of a shortage of domestic supplies.

State-operated mining company Coal India (CIL) produced 595.88mn t in 2018, up by 6.4pc year on year and delivered 603.44mn t, up by 5.4pc, as it drew down stockpiles, but limited rail rake availability slowed offtake.

1Q seaborne demand likely to be sustained

Indian thermal coal imports will likely hold steady over the first quarter as buyers seek to secure supplies amid a coal shortage in the 2018-19 fiscal year, ending on 31 March.

Demand from the cement sector is expected to remain strong after manufacturers boosted output by 8.8pc year on year in November.

The April-November cement output index was up by 14.2pc year on year, according to data from the commerce and industry ministry.

Mundra port receipts could edge up with increased coal burn at the nearby two major imported-coal based power plants. Conglomerates Tata and Adani's Mundra power plants — with installed capacities of 4GW and 4.62GW, respectively — collectively generated 5.29TWh of power last month, up by 1.3TWh year on year and climbing from 3.88TWh in November, tentative data from government agency the Central Electricity Authority (CEA) show. The two Mundra plants accounted for around 6.4pc of December's total coal power output at 82.66TWh.

A nationwide strike on 8-9 January against "anti-labour" government policies, according to the Indian National Trade Union Congress, could slow domestic coal operations this month. CIL January production in 2016-18 averaged 1.78mn t/day, with pithead stocks at the end of December 2018 estimated to be around 23.6mn t.

Indian railways have started supplying around 35 rakes/day from 5-10 rakes/day in late 2018 for the industrial sector, an industry source said. One rake can take just over 4,000t.

But power plant inventories remain low, with calls to bring coal stocks up to at least 30 days — potentially leaving industrial buyers in a precarious position for domestic coal supplies. As of 8 January, stockpiles at the 125 sampled plants totalled 17.64mn t, with enough to cover just 11 days of coal burn. Moreover, eight power plants held inventories sufficient for less than seven days. The situation has improved slightly from 14.27mn t and nine days of cover a month earlier.

And a strengthened local currency could support prompt seaborne demand. The value of the rupee against the dollar improved to Rs70.45 at London's close on 9 January from Rs71.27 a month earlier and a 2018 low of Rs74.25 on 10 October.

India thermal coal imports by coast, Y-o-Y change, versus total mn t

|

ARGUS Coal Daily International

Your source of International price assessments featuring prices such as cfr South China, fob Newcastle and more. |

|

|

ARGUS Coalindo Indonesian Coal Index Service

The leading coal price reference used by traders of Indonesian coal featuring price indexes ICI1, ICI2, ICI3, ICI4 and ICI5.

|

|

|

ARGUS McCloskey's Coal Price Index Service

Used by professionals globally, with more than 90pc of the world’s traded coal derivatives using the API 2 and API 4 indexes.

|