South Korean thermal coal imports slip in 2018

14 Jan 19, 13:14 - Coal, Steam coal, Fundamentals, Demand

London, 14 January (Argus) — South Korean thermal coal imports fell sharply year on year in December and were narrowly short of 2017's record-high total across the whole of 2018.

Thermal coal imports fell to a 13-month low of just 8.8mn t in December, customs data show, with intake across the whole of the year 940,000t lower than in 2017 at 115.9mn t. Combined thermal coal and anthracite imports were narrowly higher year on year at 124mn t.

The tail-off in demand in December follows strong receipts and low coal-fired power generation in October and November, which likely supported utilities' winter stocks. South Korean coal burn was curtailed by mild conditions and planned plant restrictions for much of the fourth quarter.

The South Korean power sector probably burned around 22mn t of coal in the last three months of 2018 and imported 28.3mn t. This would have given utilities a greater surplus than at the end of 2017 — when 22.7mn t was burned for power generation and 27.2mn t imported — with which to bolster inventories ahead of the winter.

This could mean that utilities are better stocked for the peak-winter heating season than last year, making any mild weather in the near term a palpable downside risk to seaborne demand and prices in northeast Asia.

But the temperature outlook has cooled more recently and the South Korean government says there is now a 40pc chance of below-average temperatures across the country between 28 January-3 February. Daily mean temperatures in the capital Seoul were aligned with the 10-year average over 1-10 January, but national peak power demand was 2pc higher year on year at 79GW.

Utility data also suggests that coal-fired plant restrictions will ease significantly for January-February compared with the fourth quarter of 2018, which could result in modest year-on-year growth in coal-fired power generation, even if the weather is mild.

Demand outlook for 2019

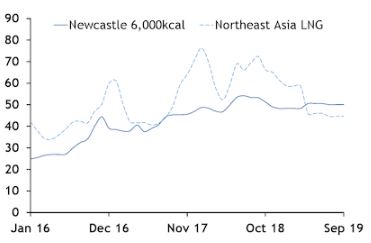

The outlook for coal demand in South Korea in 2019 as a whole could be shaped, more than ever before, by how competitive the fuel is with natural gas for thermal generation. This is because tax changes in April 2019 will raise the cost of coal-fired generation and reduce the expense of burning gas.

Based on the new tax regime and current forward Asian LNG and Australian coal prices — and assuming stable freight, exchange rates and carbon prices — gas-fired power generation costs for a 60pc-efficient plant could fall below the cost of generating from a 40pc-efficient coal-fired plant in the second and third quarters, Argus calculates.

But Australian coal is typically one of the most expensive sources of supply and the Paris-headquartered IEA said recently in its annual coal outlook that while the generation price gap between coal and gas will narrow, the price gap based on average fuel costs and plant efficiencies will continue to favour coal.

There is a chance that coal-fired generation will rise in 2019 if coal does continue to command a price advantage over gas. At 36.4GW, South Korea's installed coal capacity is 4.7GW greater than it was in May 2017, but this failed to drive a significant increase in output last year because planned restrictions limited available capacity to around 30.2GW across the year, which was flat to 2017.

The utilisation rate of installed capacity then fell to 75pc last year, from 80pc in 2017, but could recover if restrictions are less severe in 2019. Coal burn would rise by a little more than 1mn t/year for every percentage-point increase in the use of South Korea's installed capacity.

Utilities tend to announce maintenance plans around April each year, but it is already known that 3.32GW of coal capacity will be fully suspended during March-June as part of an annual government policy to reduce fine particle emissions.

Sulphur-content dictating buying preferences?

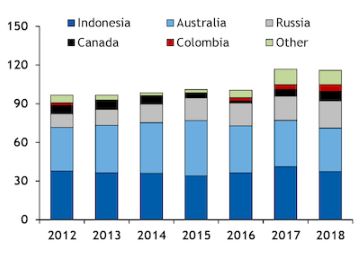

South Korea is also understood to be trying to source lower-sulphur coals as part of efforts to combat poor air quality, and this was borne out in changes to its supply mix in 2018.

Australia and Indonesia remained by some distance South Korea's biggest suppliers, but imports fell sharply year on year. Receipts from Indonesia fell by 3.8mn t compared with 2017 to 37.4mn t last year, with volumes from Australia down by 2.2mn t to 33.7mn t — the lowest for at least seven years.

But Russia, Colombia and Canada — suppliers of comparatively low-sulphur material — all delivered record volumes to South Korea in 2018. Imports from Russia grew by more than 2.2mn t to 20.9mn t, while receipts from Canada and Colombia rose by 2.4mn t and 1.4mn t, respectively, to 7.5mn t and 5.2mn t.

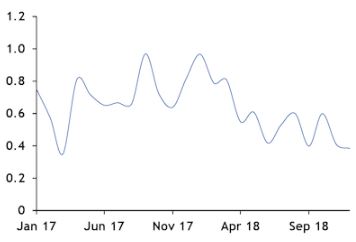

Tender data collated by Argus show a trend in South Korean appetite for lower-sulphur coals, which looks set to continue this year. The volume-weighted average sulphur limit demanded in South Korean tenders has been 0.5pc since April 2018, which is down from 0.73pc in the prior 15 months.

South Korean annual thermal coal imports mn t

Sulphur limit in South Korean coal tenders %

South Korean generation costs $/MWh

|

ARGUS Coal Daily International

Your source of International price assessments featuring prices such as cfr South China, fob Newcastle and more. |

|

|

ARGUS Coalindo Indonesian Coal Index Service

The leading coal price reference used by traders of Indonesian coal featuring price indexes ICI1, ICI2, ICI3, ICI4 and ICI5.

|

|

|

ARGUS McCloskey's Coal Price Index Service

Used by professionals globally, with more than 90pc of the world’s traded coal derivatives using the API 2 and API 4 indexes.

|